今日要闻

Global Economics 全球经济

Diverging Fortunes 命运不同

美国可能正在蓬勃发展,但全球经济开始放缓……

这造成的压力分歧令人不安

在新兴经济体长期情况则不同.....

Summary

The short vs the long

短vs长

一个简单的动态景象正在全球经济中上演:美国正在蓬勃发展,而大多数国家世界其他地区的增长放缓甚至停滞。由这个问题引起的应力是在许多新兴市场上演着令人不安的一幕。美联储正在加息防止美国经济过热,利率限制了政策选择这些国家的金融状况正在收紧,贸易紧张局势不断加剧。

然而,无论短期压力如何,长期前景很可能会明显不同。

我们的新分析(见第17页)表明,新兴经济体将是全球经济增长的主要推动力

相对于面临人口挑战的国家而言,全球经济具有优越的长期潜力发达市场。明年左右,美国经济可能继续超越其他国家,但未来10年左右的时间里,新兴市场(尤其是亚洲)应该牢牢掌握在自己手中。

A simple dynamic is playing out in the global economy right now: the US is booming, while most of the rest of the world slows or even stagnates. The stresses caused by this divergence are playing out uncomfortably in many emerging markets. A US Federal Reserve that is raisinginterest rates to prevent the US economy from overheating is constraining the policy options ofcountries where financial conditions are tightening and trade tensions intensifying.

Whatever the short-term strains, however, the long-term picture is likely to be markedly different.

Our new analysis (see page 17) suggests that emerging economies will be the big drivers of theglobal economy, given their superior long-term potential relative to demographically challengeddeveloped markets. The next year or so may see the US economy continue to outshine others butthe next decade or so should belong firmly to EM, particularly Asia.

Decoupling?

这已成为一个耳熟能详的故事:就像我们上一套季度预测修正版一样,这个季度也是如此,我们是否会再次调高对美国2008 -2019年经济增长的预测,并调低对中国经济增长的预测世界上大部分地区。汽油价格可能会走高,真正的联邦基金利率终于有了这是十多年来首次出现好转,美中贸易紧张局势加剧

然而,财政刺激仍在继续提振经济。个人减税和创历史新低失业率帮助美国消费者信心升至18年来的高点,税后表现强劲企业利润增长意味着投资支出前景进一步明朗。那么,今年已经加息三次的联邦公开市场委员会(FOMC)是否自信满满就值得怀疑了,预计中国将在未来一年继续以类似的速度收紧政策。

世界其他地区看起来不那么耀眼,但还没有什么太令人担忧的。欧洲已经很明显从2017年末的高点放缓,企业信心仍在走软,但增长依然存在略高于潜力,在日本也是如此。只有阿根廷和南非这样的国家。实际上,许多新兴经济体已经陷入衰退,但它们的增长正在放缓,或将进一步放缓接下来的几个月。因此,尽管加息对美国国内可能有意义随着世界其他地区的经济失去动力,其他国家也不明显应该效仿。然而,正如最近几个月所显示的,选择可能并不完全是他们的

It is becoming a familiar tale: as with our last set of quarterly forecast revisions, the story this quarteris once again to revise up our US growth forecasts for 2018-2019 and to edge down our forecasts for

much of the rest of the world. Gasoline prices may be higher, the real Fed Fund’s rate has finallyturned positive for the first time in more than a decade and US-China trade tensions have heightenedyet again but the fiscal stimulus continues to provide a lift. Personal tax cuts, together with record-lowunemployment, have helped to raise US consumer confidence to an 18-year high and strong aftertaxcorporate profit growth means the outlook for investment spending has brightened further. Littlewonder then that the FOMC, which has already raised rates three times this year, is confidentlypredicting that it will continue to tighten policy at a similar rate in the coming year.

The rest of the world is looking a little less stellar but nothing too worrying as yet. Europe has clearlyslowed from the highs of late 2017 and business confidence is still softening but growth remainsslightly above potential and it is a similar story in Japan. Only the likes of Argentina and South Africaare actually already in recession but much of the emerging world is slowing or set to slower further inthe coming months. Hence, while higher interest rates might make sense for the domestic USeconomy, with much of the rest of the world losing momentum, it’s not obvious that other countriesshould follow suit. And yet, as recent months have shown, the choice may not be entirely theirs.

Impact of triple shocks still unfolding in EM

We set out our stall regarding the outlook for EM in Triple shock, 28 June 2018, and see littlereason to change the message contained in that report now: US tightening, higher oil prices andongoing trade frictions are all taking their taking their toll on the growth outlook. Some of thepressure on EM may have faded as the dollar has reversed some of its appreciation but,dragged down by higher rates, tighter lending standards and falling equities, EM financialconditions are still tightening. The fallout in the most-affected countries is only just starting to befelt and the relief may prove short-lived. Our FX strategists expect the dollar’s rise to resume,the oil price has recently been on the rise again, as we expected, and in the near term we see agrowing risk it could touch USD100/b. Moreover, the latest round of 10% tariffs on USD200bn of

您可能敢兴趣

声明: 凡注明为其他媒体来源的信息,均为转载自其他媒体,转载并不代表本网赞同其观点,也不代表本网对其真实性负责。如系原创文章,转载请注明出处; 您若对该稿件内容有任何疑问或质疑,请即联系,本网将迅速给您回应并做处理。邮箱:mail@laishu.com

为您推荐

校园贷再曝乱象这到底是什么情况,了解最新消息?

2018-04-15 21:34

8月分手魔咒:不平衡的爱情注定走不远

2018-08-21 11:37

饮食提醒切记红薯的“死对头”

2018-02-21 03:39

红唇族加烟酒 罹癌增123倍 医师告诉你危害不只这些...

2019-11-06 17:37

秋葵,生菜

2020-01-27 07:42:15

滑坡毁百年铁轨 怎么回事

2019-02-02 05:46

解读改善你的饮食的3款创新菜肴

2018-02-25 03:39

李湘为女儿庆生 一家人真是太有爱了

2019-01-25 19:26

生完二胎后首露脸!福原爱瘦14公斤身材纤细

2019-07-27 12:32

2018CBME孕婴童展益生碱奏响全球备孕最强音

2018-08-01 13:46

月经不调饮食来调

2018-04-01 10:37

粗盐热敷4个部位治好4大顽疾可惜很少有人会用

2019-03-05 22:46

讨厌金牛座的人 是因为不懂金牛座 他们其实和你想像中的不同

2019-07-02 16:13

他才出生四天,四肢黑到要截肢、一碰就可能死亡!这一切只因爸妈一个无知的决定…

2018-02-17 12:45

石家庄现天价板面 为何如此天价 哪些人来吃

2019-02-02 04:47

统一西武双狮联名活动 日职传奇球星东尾修开球

2019-07-15 21:31

街头最红三大台式水果茶!!斗分量斗特色斗选择

2018-05-13 22:37

9个月婴儿如何进行认知能力训练

2018-02-15 01:00

最会伤人、伤人至深的十二星座排行榜 人必有一死 死于天蝎或死于水瓶

2018-05-03 06:34

对现任够深情 对前任够狠心的星座 第一名:金牛座

2019-07-08 16:18

滴滴顺风车回归 具体何时能归 消费者:等你回归

2019-04-15 20:39

从“出汗多”看体质?谨记养生方法,值得收藏!-今日头条(www.toutiao.com)

2018-01-11 23:45

备孕 你知道备什么吗?

2018-09-05 09:51

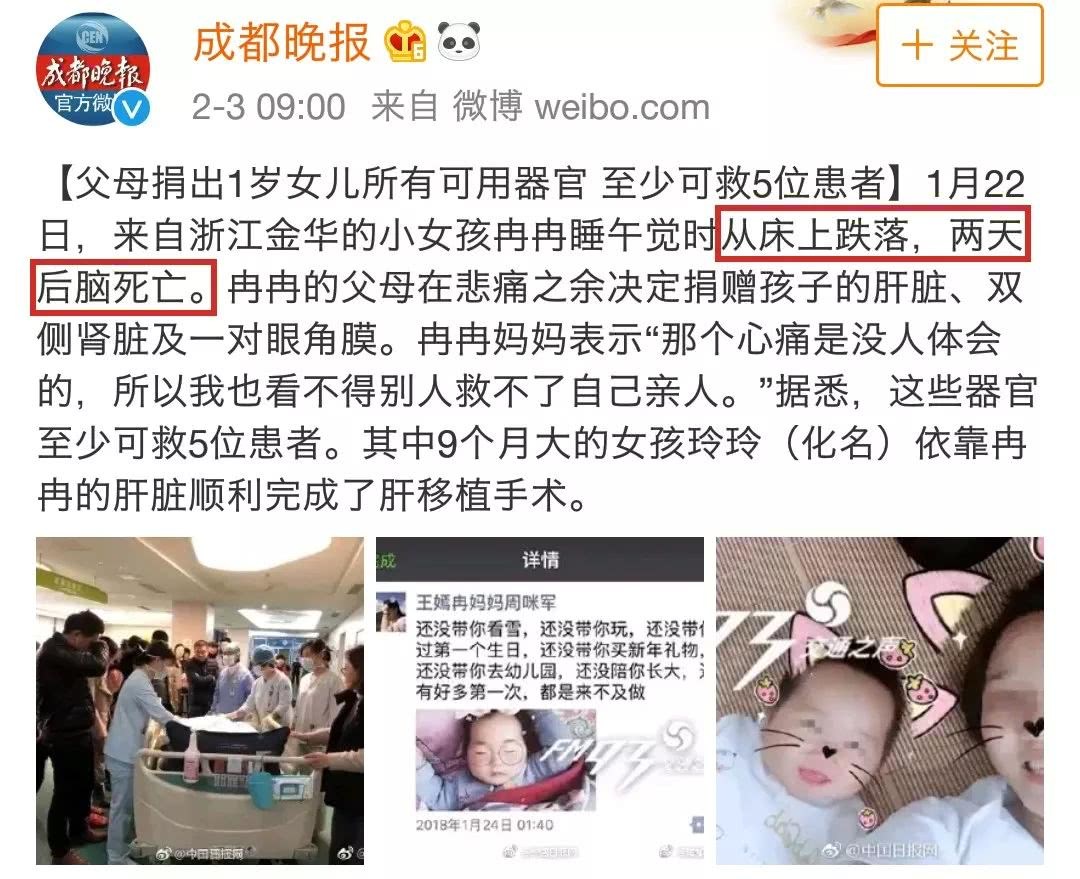

宝宝颅内出血、脑死亡竟是因为掉床 孩子坠床后万不可做错这3件事…

2018-10-16 12:57

日职/令和的怪物石垣岛初上陆 专属商品卖翻天

2020-09-17 12:51:25

新光三越彩虹市集改装结集60家餐厅品牌这5家人气超旺

2018-05-11 12:39

蝉联七年癌症死因第一名!预防大肠癌吃两物:越浓稠越抗癌,日本人爱吃、不想得癌更要吃|每日健康 Health

2019-03-21 21:53

每日排尿1500CC. 与尿路结石说再见

2019-10-25 18:35

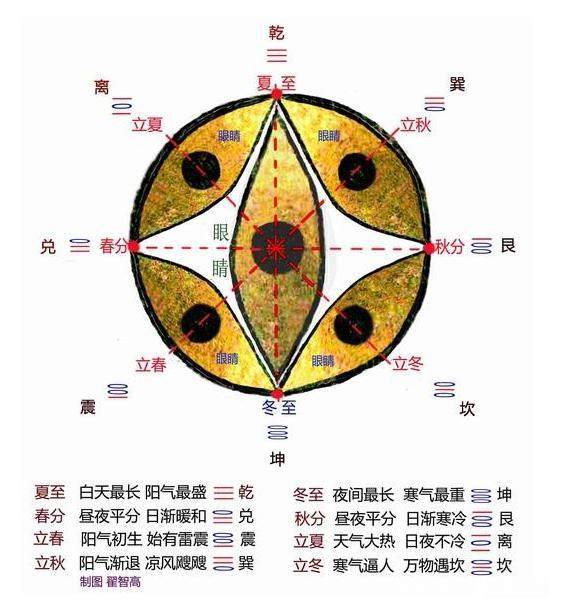

原来这个八卦卦序的原理是这样的 其背后隐藏高深的宇宙奥秘

2018-05-10 04:36

只不过用硬币刮“这里”,不到3天!!五脏六腑的毒素竟然全排光了!便秘没了、气色也好了!效果太惊人。。。

2018-01-27 16:45

今日要闻

Dr. Martens联名X-GIRL释出霸气厚底系列!音乐人、潮流人都该来一双

真的来了!GD亲晒PEACEMINUSONE x Nike AF 1,白色“Para-Noise 2.0”超欠买!

adidas推出城市Online Run!王阳明、雷理莎脚踩Supernova、Boston 9限定鞋畅跑信义区

德国鞋履品牌Trippen秋冬新入荷!经典&创新任你选!

阿部千登势再推神作!sacai x Nike Vaporwaffle联名释出,四款新色攻陷你的荷包!

还有机会入手!Off-White x Air Jordan 5“色违”版本联名鞋即将开卖

Joel Embiid首代签名篮球鞋“UA Embiid One”台湾正式发售

Dr. Martens经典再进化!Heritage Distortion系列“双黄线”震撼登陆